Take the survey to find out...

How Much You Can Reduce

Your Tax Debt In 2026:

And if you complete the survey now, in the next 24 hours you could be out of line for collections and stop the IRS from suddenly withholding your paycheck, putting a lien on your house or car, or seizing your bank account...

Your responses are 100% secure

and will never be shared with anyone.

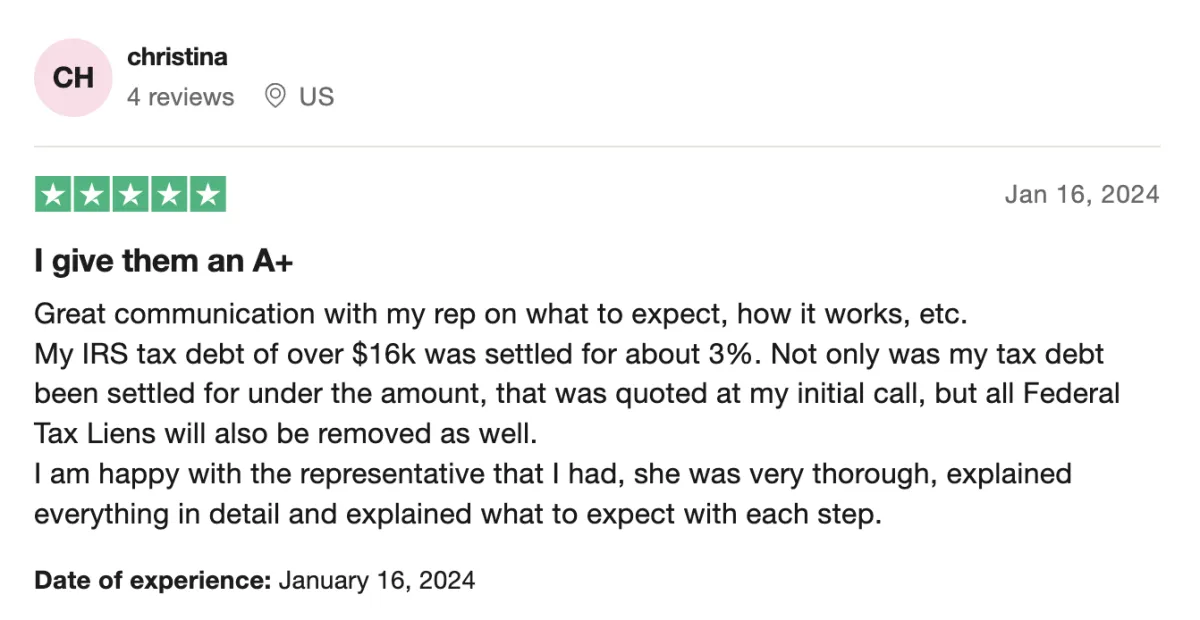

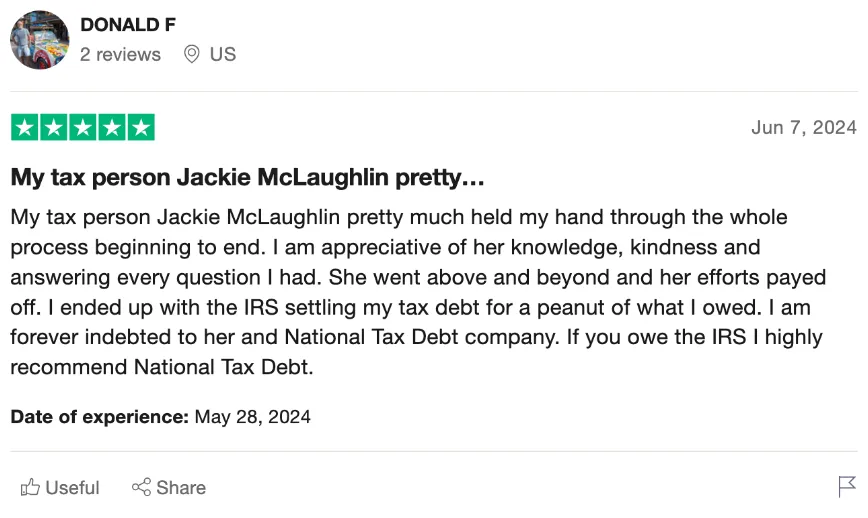

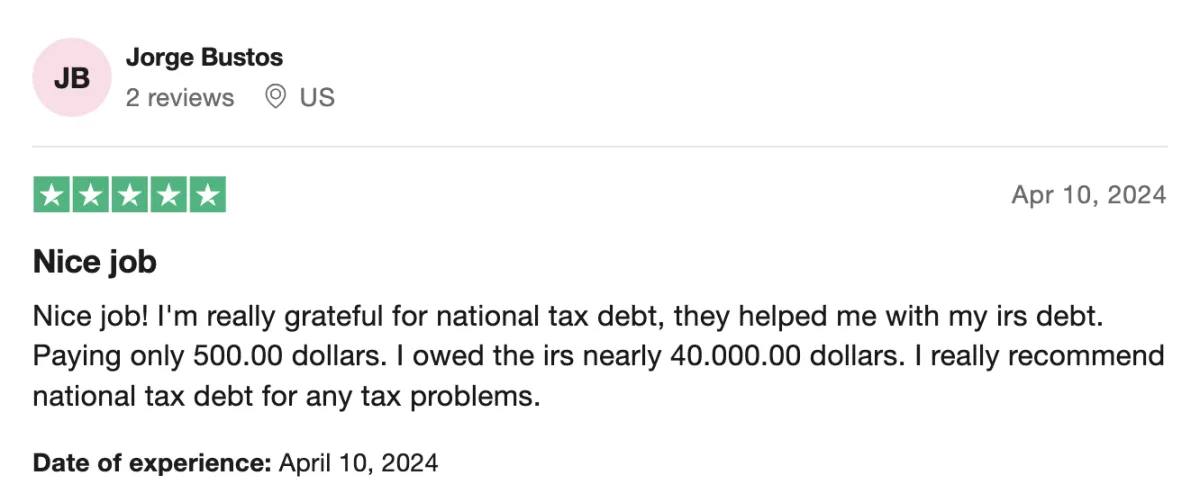

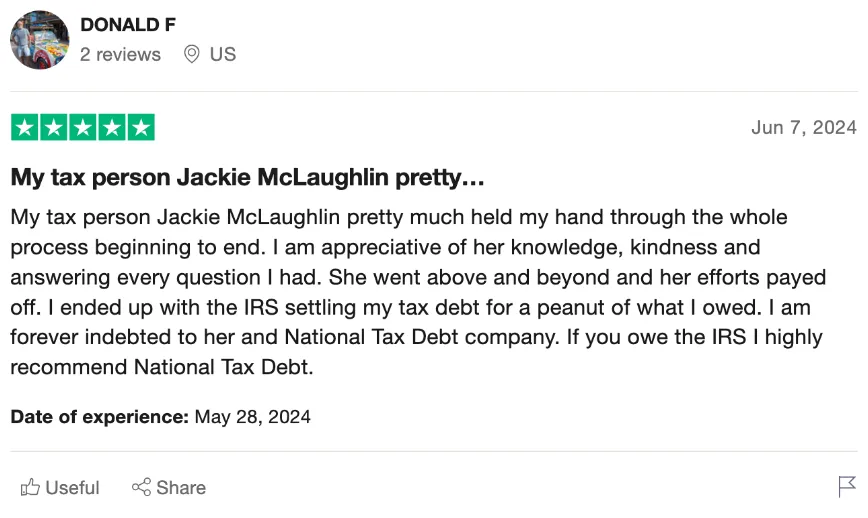

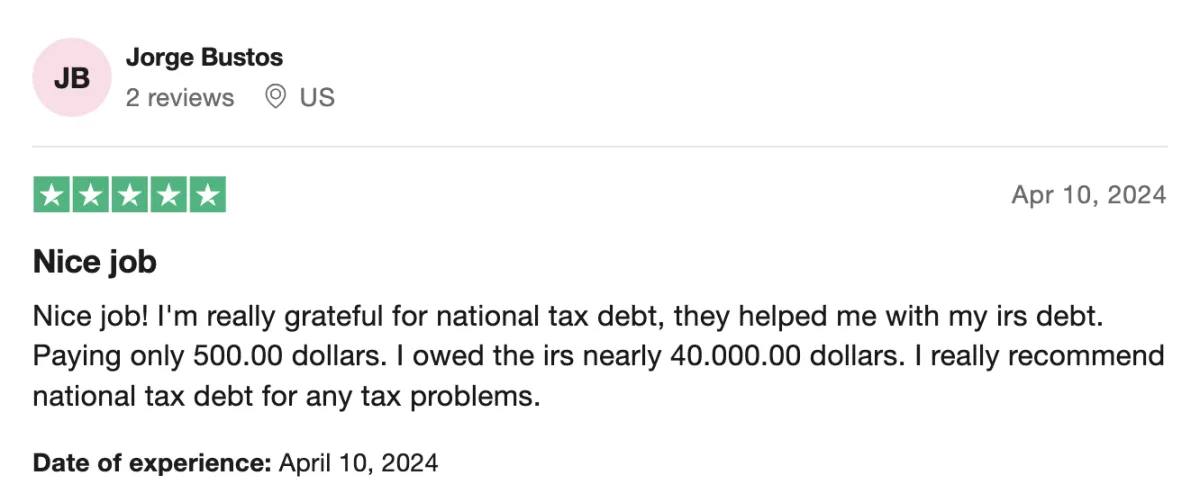

Trusted By: